Forums

Talk about anything you want!

Login to get your referral link.

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

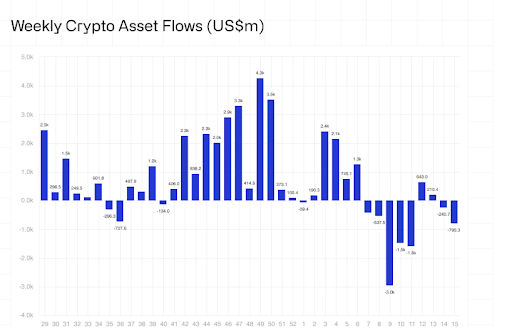

The price of bitcoin continues to cope with opposite winds, as the last report on Digital asset fund flow Watch a $ 751 million staggered out of digital assets. The pure volume of this withdrawal increases alarms on the question of whether Institutions can take flagship cryptocurrency.

Coinshares weekly report On digital asset funds, a huge $ 795 million out From the cryptography market, of which $ 751 million came from the only bitcoin. This massive exodus marks one of the biggest outings of a week of the year, and it arrives at a time when the The price of Bitcoin hit a wall.

James Butterfill, chief of research in Coinshares, has revealed that since early February 2025, digital asset investment products have suffered from cumulative outings About $ 7.2 billion, effectively efforcing almost all the entries of the year. In particular, this week marks the third consecutive week of decline, with Bitcoin leading the slowdown And save the most important losses among the main digital active ingredients.

From this report, the 2025 net flows decreased to a modest of $ 165 million, a clear drop compared to a peak of several billion dollars barely two months ago. This strong decline highlights a Challenge of feeling among institutional investors And highlights an increasing feeling of prudence in the midst of the volatility of the current market.

Currently, the The price of bitcoin is in difficulty To use the heights of all time, the recent outings used for one of the many obstacles hindering cryptocurrency escape. Until these outings are reversed and the market stabilizes, the Bitcoin path to establish new heights of all time remains disputed.

Despite the loss of $ 751 million in outings, Bitcoin still maintains a moderately positive position with $ 545 million in net entries at the start of the year. However, the scale and speed of the last outings arouse concern. The fact that Bitcoin has undergone such a massive withdrawal signals a potential change in feeling among institutions. Whether due to taking advantage or a macroeconomic uncertainty, this decision suggests that the big players are starting to withdraw – at least in the short term.

In addition to Bitcoin, Ethereum saw $ 37 million in outings, while Solana, Aave et Suis also posted losses of $ 5.1 million, $ 0.78 million and $ 0.58 million, respectively. Surprisingly, even short Bitcoin products, designed to benefit from market slowdowns, were not spared, recording $ 4.6 million outings.

One of the main drivers of decline on digital assets is increasing economic uncertainty triggered by tariff policies that have influenced the feeling of investors. The wave of negative feeling started in February after the President of the United States (United States), Donald Trump, announced his intention to impose prices On all the imports entering the country from Canada, Mexico and China.

However, an end -of -week rebound in cryptographic prices was seen after Temporary reversal of controversial pricesOffering a brief respite for the market. This change in policy has contributed to increasing the total assets under management (AUM) on digital assets, to a lower $ 120 billion on April 8 at $ 130 billion, marking an 8%resumption.

Adobe Stock star image, tradingView.com graphic

1

Voice

0

Replies