Forums

Talk about anything you want!

Login to get your referral link.

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum (ETH) has been negotiated at its lowest levels since the end of 2023, has trouble resuming the momentum after a long period of sales pressure. Since December 2024, ETH has lost more than 57% of its value, not recovering keys resistance levels. With the wider market of cryptography in the face of macroeconomic uncertainty and persistent volatility, the downward trend of Ethereum appears far.

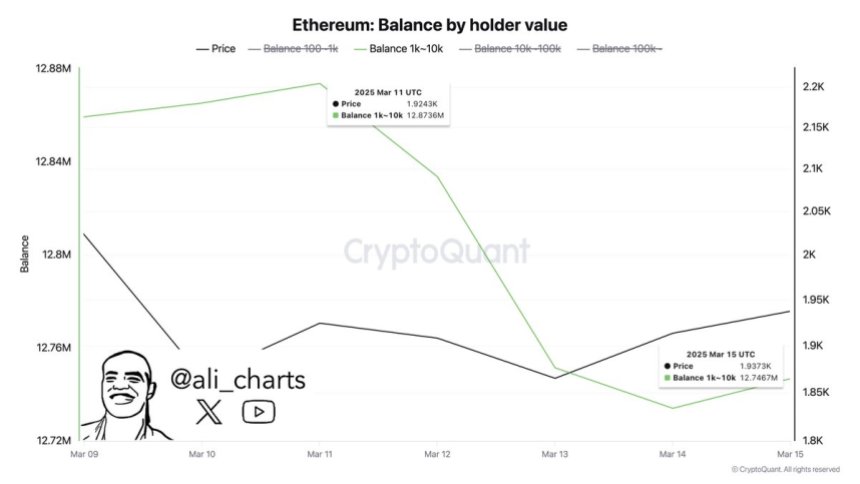

Despite the continuous decline, the data on the chain suggest that large investors can position themselves for a recovery. According to Cryptochant, whales moved more than 130,000 ETH exchanges during last week, signaling a tendency to increasing accumulation. This model has developed since Ethereum started to decrease, suggesting that institutional actors and long -term holders buy the decline in anticipation of the appreciation of future prices.

While short -term feeling remains lower, historical data show that large accumulations of whales often precede strong rebounds once the sales pressure is faded. However, the ETH still faces significant resistance and the bulls must recover key levels to confirm a potential tendency reversal. The uncertainty of the market being always imminent, the coming weeks will be essential to determine the next major movement of Ethereum.

Ethereum has undergone massive pressure of sale, in difficulty in the midst of macroeconomic uncertainty and fears of trade war that have shaken both the crypto market and the US stock market. ETH is now negotiated below a level of multi -year support, which could act as strong resistance in the coming weeks. If the bulls fail to recover the key price levels, the scene could be fixed for a deeper correction.

However, not all indicators are fucked. Despite the current tendency in progress, some analysts remain optimistic about the long -term prospects of Ethereum. High -level analyst Ali Martinez shared information on X, revealing that the whales moved more than 130,000 ETH exchanges during last week.

This is important because large investors generally move their assets from exchanges when they plan to keep long -term rather than sell. When the whales transfer eTH to private wallets, this often signals accumulation rather than immediate sales pressure. Historically, these trends have preceded rebounds on the market, because a reduction in the exchange of exchange can contribute to the stability of prices and the future potential of increase.

While Ethereum still faces major obstacles, whale activity suggests that smart money is positioned for the next movement. The next few weeks will be crucial to determine if the ETH can reverse its downward trend or if other decrees are ahead.

Ethereum is currently negotiating at $ 1,904, finds it difficult to resume the momentum after days of consolidation below the bar of $ 2,000. The current sales pressure has maintained ETH under key resistance, making it difficult for bulls to reverse the trend and start recovery.

So that Ethereum finds an upward perspective, the bulls must recover the level of $ 2,000 as soon as possible. A push supported above this resistance would signal the force and could prepare the ground for a rally to higher levels, potentially testing $ 2,250 to $ 2,400 in the coming weeks.

However, if the ETH loses current demand levels, the next main liquidity area is around $ 1,600. Ventilation less than $ 1,750 could trigger other sales, leading to an extended bearish phase which could delay any potential recovery.

With the accumulation of whales increasing and on the data on the chain suggesting a reduction in the exchange offer, some analysts think that Ethereum could soon try a break. However, macroeconomic conditions and the overall feeling of the market remain critical factors to determine the short -term trajectory of the ETH. The bulls will need high purchase pressure to recover the lost land and avoid a deeper drop.

Dall-e star image, tradingview graphic

post url: https://altcoin.observer/130000-ethereum-left-exchanges-haussier-signal/

1

Voice

0

Replies