Forums

Talk about anything you want!

Login to get your referral link.

The meeting of the Federal Open Market Committee (FOMC) is set for Tuesday and Wednesday, and investors are at the forefront. The markets are careful about all signals on interest rates, especially after the president of the federal reserve, Jerome Powell, suggested a waiting approach. The American economy is already faced with uncertainty due to new politicians, in particular aggressive prices, and the impact begins to show.

Actions vacillate, the feeling of investors is fragile and the cryptography market feels heat. In just 24 hours, the global cryptography market dropped by 3.1%, Bitcoin and Ethereum slipping both.

Are we directed towards trouble? Let’s take a closer look at what’s going on.

Bitcoin recorded a sharp decrease of one day of 2.09% yesterday, closing at $ 82,577. In the past 24 hours, it decreased by 1.9% additional. However, for the moment, it is slightly negotiated at $ 82,888, up 0.37% compared to the closing price of yesterday.

Ethereum also experienced a significant drop, from $ 1,935 to $ 1,886 yesterday, a drop of 2.52%. In the past 24 hours, it has lost an additional 2.4%, although it was slightly recovered at $ 1,888.

Analysts believe that this drop in feeling is largely motivated by concerns about policies and economic regulations.

At the start of the FOMC meeting, most experts predict that the Fed will not make any change in interest rates. Currently, the rate of federal funds remains between 4.25% and 4.5%, without immediate adjustment expected.

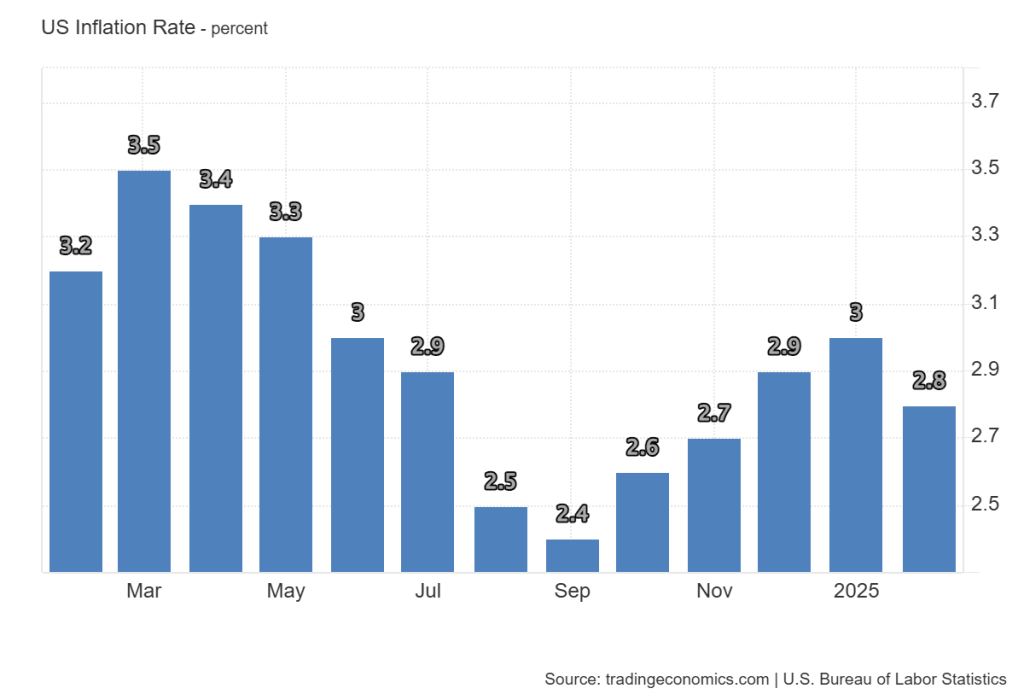

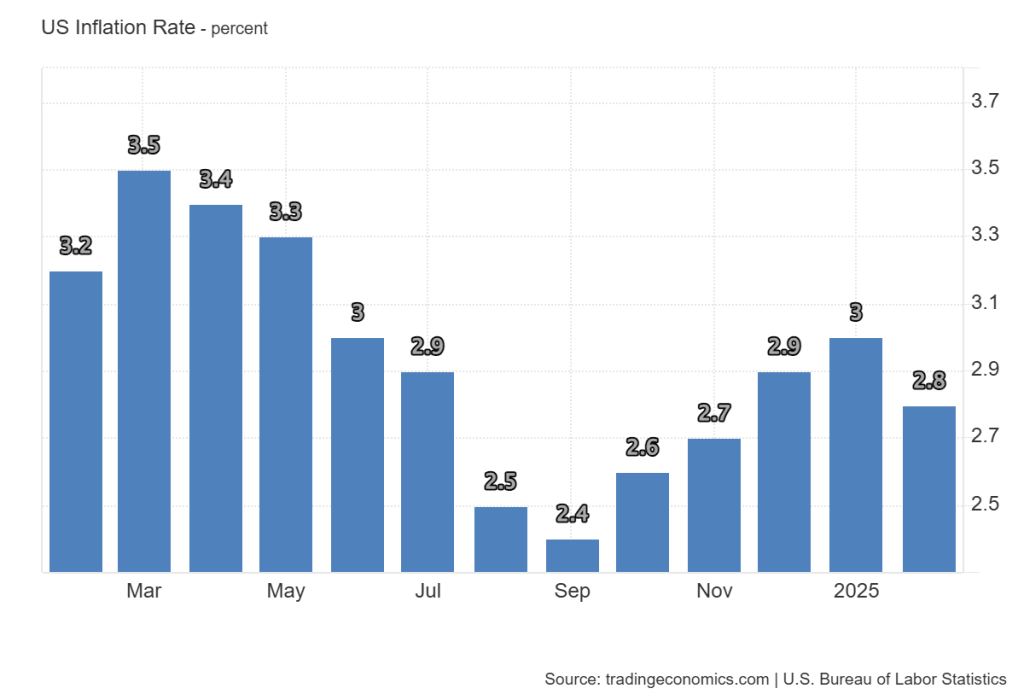

At the same time, inflation in the United States has gradually decreased. In February, it went from 3% to 2.8% and forecasts suggest that it could drop to 2.5% in March.

President Donald Trump

Many believe that the Fed will avoid making major decisions about interest rates until the economic impact of these trade policies becomes clearer. However, some experts warn that prices could increase inflation, which could complicate the future approach of the Fed.

The stock markets were also affected by uncertainty. The term contracts linked to Dow Jones, S&P 500 and Nasdaq Composite have all decreased, reflecting the prudent feeling of investors.

The cryptocurrency market has followed suit, with almost every ten best digital assets with losses in the past 24 hours:

Despite 253 million dollars in term crypto liquidation during the last day, the lever effect remains high, which suggests that traders are still taking risks. The funding rates have stabilized at neutral levels, indicating a mixed feeling on the market.

For the moment, crypto traders are looking for a clear signal to determine the next market movement. A change in Fed policy or a major institutional investment could provide this catalyst. Until then, volatility should continue.

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends

1

Voice

0

Replies